Your Retirement Depends 100% On You!

People often think of retirement in abstract terms – far away, undefined, difficult to envision.

Do you find yourself asking these questions?

How much should I be saving toward retirement?

Do I have enough money to retire?

How do I manage my retirement funds?

How do I manage my money in retirement?

How much money do I need to retire?

When can I begin my Social Security?

When should I start my Social Security?

What do I do with my 401k after I leave my job?

What do I do with my 401k after I retire?

Does the 4% withdrawl rate still apply?

When can I sign up for Medicare?

How much does Medicare cost?

No matter where you are within your retirement savings journey, we can help put your retirement goals into better focus.

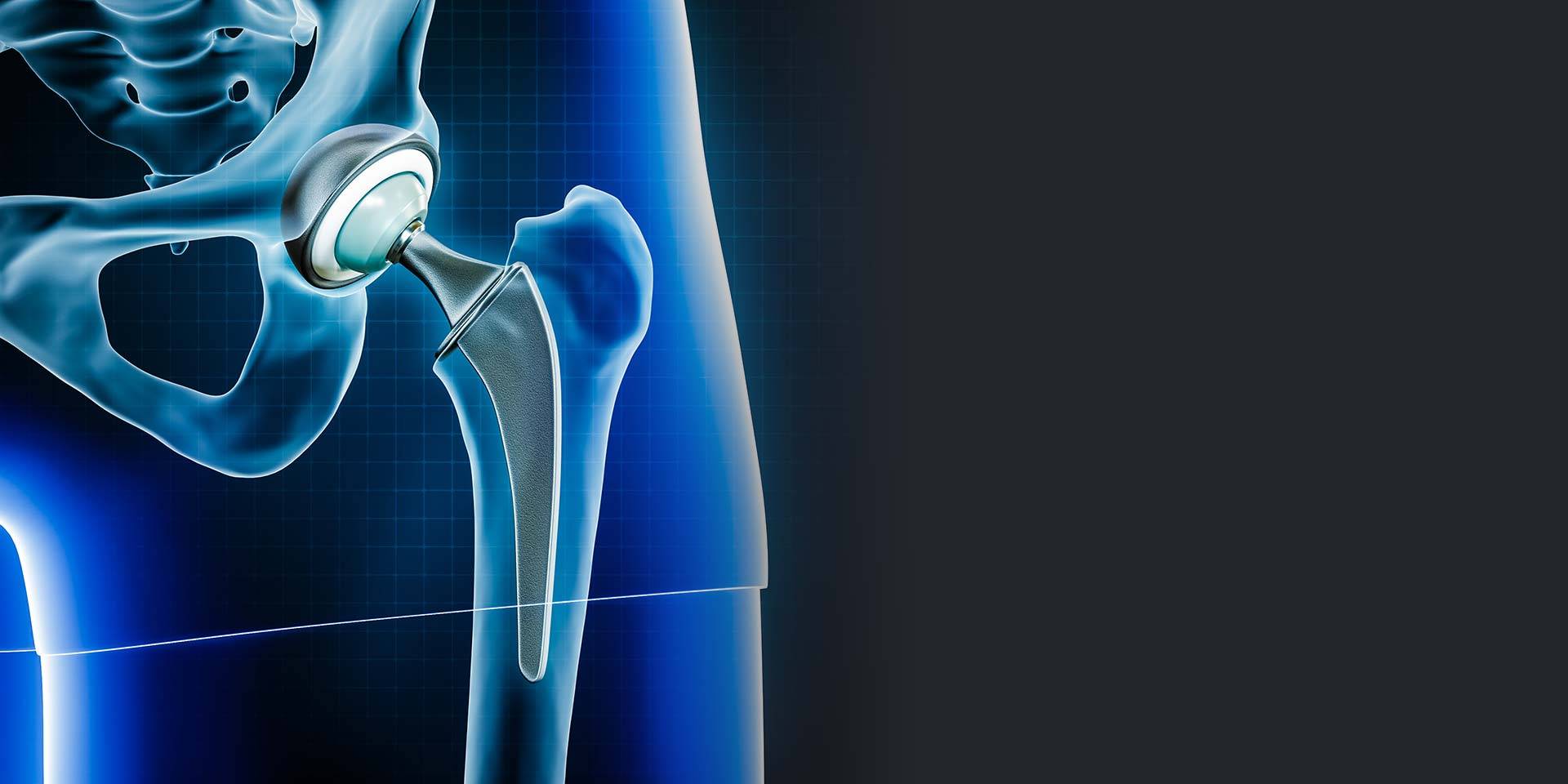

We manage client relationships from all walks of financial life. We are also the leading financial experts worldwide for those who are employed by the orthopedic industry.

Why is Retirement Planning Important?

Retirement planning is the process of creating a plan to help you achieve your desired retirement lifestyle. Everyone wants a golden retirement, but saving for retirement is no easy task. This plan involves assessing your current financial situation, setting retirement goals, determining the income you’ll need, and creating a plan to save and invest for retirement.

Planning for retirement is essential because it helps you avoid the risk of outliving your savings and allows you to enjoy your retirement years without worrying about finances. It also helps you create a sense of financial security, enabling you to focus on the things that matter most to you in retirement.

We Are THE Financial Advisors

for THE Orthopedic Capital

of the World

For over 30 years, our Financial Advisors are specifically trained to assist employees who are employed by Orthopedic Industries worldwide and in Warsaw – the Orthopedic Capital of the World. To get started, have a conversation with us – we are here to help guide you through your financial goals and beyond retirement.

We can help you plan for retirement by answering questions such as:

- How much do I need to save each year to achieve my retirement goals?

- What type of retirement plans should I invest in?

- Which investment portfolio will give me the highest probability attaining my goals?

- How much money can I safely withdraw from my investments each year without running out of money?

- At what age should I start taking Social Security?

- How can I maximize my social security benefits?

- What affect will health care costs, taxes and inflation have on my retirement?

We are passionate about helping people make smart financial decisions and we take great pride and enjoyment in helping you live the retirement lifestyle you desire and deserve, because the best plans have a clear outcome in mind.

Want to Learn More?

The best way to begin investing in your life’s future is by starting a conversation with us. Our advisors are here to help and guide you through your financial goals without the use of high-pressure sales tactics. At Alderfer Bergen & Co. there are no initial consultations fees, no obligations and therefore, no stress.